Safari Online: Pricing Analysis

Overview

O'Reilly Media is a dominant force in the technical publishing industry. Famous for its books featuring animal woodcuts on their covers, the firm's products have become a mainstay amongst programmers and technologists.

For fifteen years, O'Reilly has made its books available online via its wholly owned subsidiary Safari Books Online.

Many have commented upon Safari's online offerings, but few have analyzed its pricing strategy. This document examines Safari's pricing page and provides suggestions for improvement in order to increase the firm's profitability.

Scope & Limitations of Analysis

The scope of this analysis is limited to Safari's pricing page [cached screenshot].

- No attempt was made to research the offerings of competitors, the marketing landscape, the firm's product positioning or trends in digital publishing.

- No attempt was made to examine any pages on Safari's website that were external to the firm's pricing page.

- No external sources were referenced in the creation of this document.

- No proprietary information was used to perform this analysis. A more detailed study would require additional information including, but not limited to: company goals, product strategy & roadmap, usage statistics, the effects of actions by rivals, revenue trends and customer feedback.

- This document is not intended to be comprehensive in nature. It is only intended to serve as a point of discussion.

- As always, caveat emptor.

Disclaimers

- This analysis was completed on October 1, 2016. No changes made to Safari's pricing model after this date are reflected in this document.

- This document was not requested by Safari Online, O'Reilly or any external company. Compensation of any type was neither requested nor given.

Current Pricing Strategy

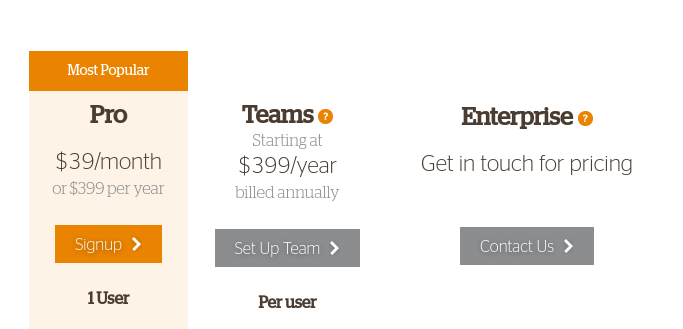

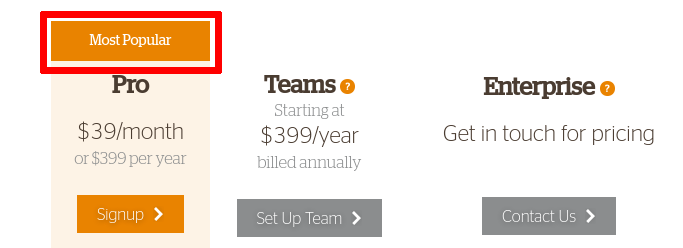

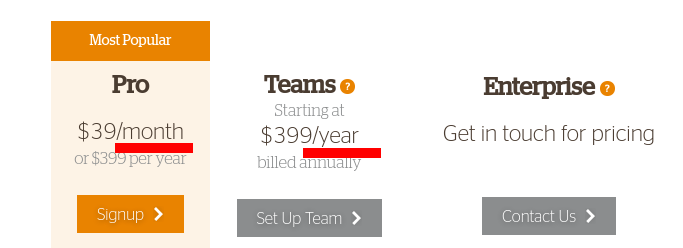

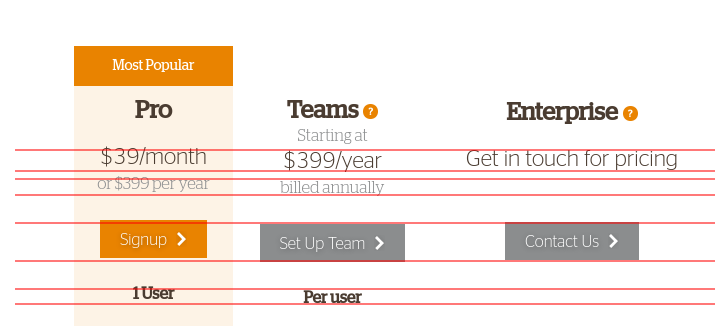

At first glance, it appears that Safari chose to utilize the common strategy of creating a three-tiered offering.

Pricing tiers typically work by offering increasingly valuable goods at increasingly higher price levels. This tactic allows firms to target multiple price points in a market, and maximize revenue from different customer segments.

The availability of tiered offerings is reinforced by the page's header that provides a strong call to action: Choose the plan that's right for you.

As a call to action, it looks pretty good. The firm is providing choice to the consumer. He can spend as much as he wants for an offering that is custom tailored to his needs.

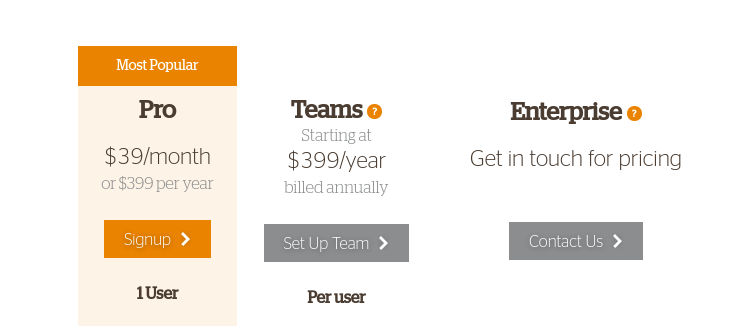

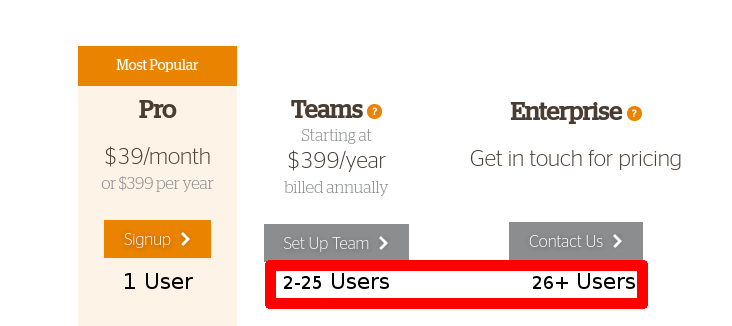

A closer inspection reveals something startling however - the options available to potential buyers do not represent classical tiering in the usual sense. Although the plans do offer escalating levels of value, there is no evidence of increasing prices for the higher-level plans. In fact, plan selection is not governed by customer willingness to pay at all - the number of users dictates which plan a user may select. In essence, the firm has opted for a form of a graduated per-seat pricing model.

While some customers may appreciate the simplicity of purchasing decisions made using this model, it will almost certainly require Safari to hyperfocus its offerings on narrow subpopulations of its potential customer base - leading to reduced income and market share.

Companies that provide access to generic, low-value goods (like plain salt) are forced to offer discounts for high volume buyers, due to competition. Safari is not a purveyor of generic goods. It offers a proprietary catalog of highly respected books and bears the name of a well respected firm as its owner.

Comparing the Pro and Teams Packages

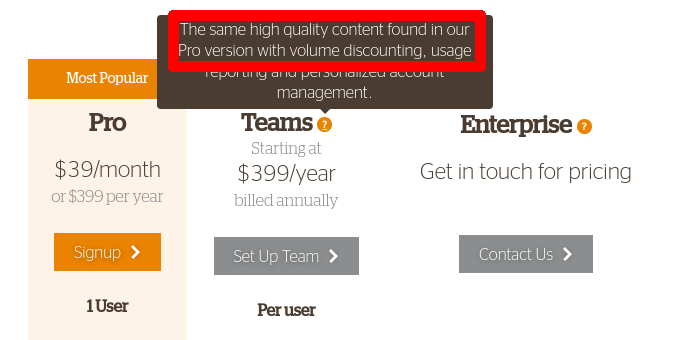

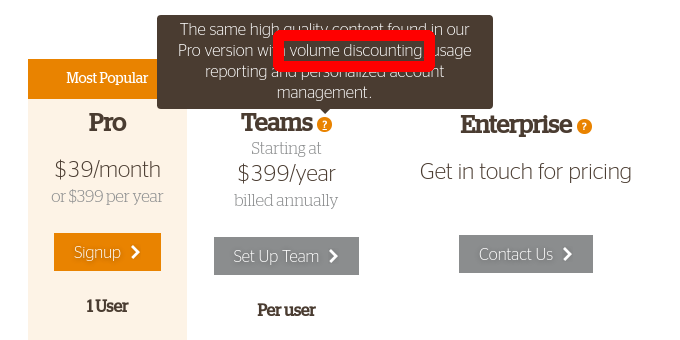

The first two packages are exceedingly similar, both in terms of price and perceived value to consumers. This statement is by no means subjective. As seen in the image below, the higher package offers the same price point as the lower tier and even uses the language "The same high quality content found in our Pro version." This proved highly problematic as is outlined below.

Pricing Issues

It is nearly a truism that premium offerings should carry premium prices. There are edge cases that break this rule, but one should always examine exceptions with a great deal of skepticism.

When one looks at most product lines, an effort is typically made to increase the perceived value of the lowest tier by explaining its similarities to a more expensive offering. Such language causes the lower-tiered item to command a higher price. Rarely will one see an example describing how an upper tier offering has similarities to a lower tier good. Such statements will only serve to reduce the premium that buyers will be willing to pay for the higher level offering.

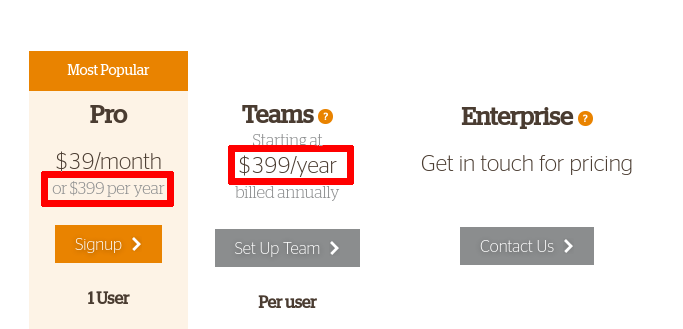

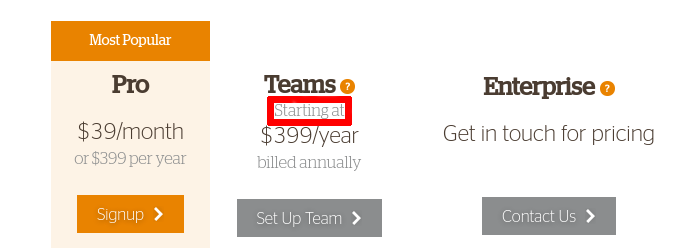

The two lower offerings by Safari are both offered at the same exact price: $399 / seat / year.

Many would think that a firm with two potential Safari-users would opt to purchase the Teams plan, given that both are the same price. After all, both are listed at $399 and the Teams plan offers more value.

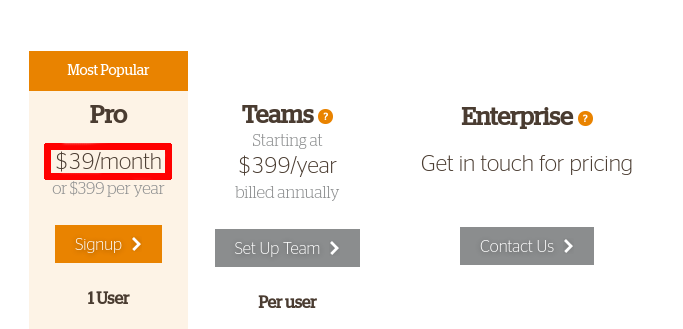

The answer is a bit less clear. While the Pro plan offers fewer features, it does have one aspect that might prove quite desirable to cash-strapped buyers: a monthly pricing option.

Safari removed the flexibility in payment for those at the higher of the two tiers. This is almost certainly a mistake. As a general rule, higher tiers should only add to the value being delivered from the lower tier. It should never remove value.

Remember, one goal of tiering is to prompt potential buyers to consider the benefits of spending more money to purchase more expensive options. It is rare for a business to find any value in prompting potential customers to consider spending less money, rather than more.

Feature Similarities

This similarity between plans should be a cause of grave concern, as the presence of each additional offering acts as conceptual complexity for the buyer and reduces the ability of the vendor to introduce additional pricing tiers that can address the needs of other market segments.

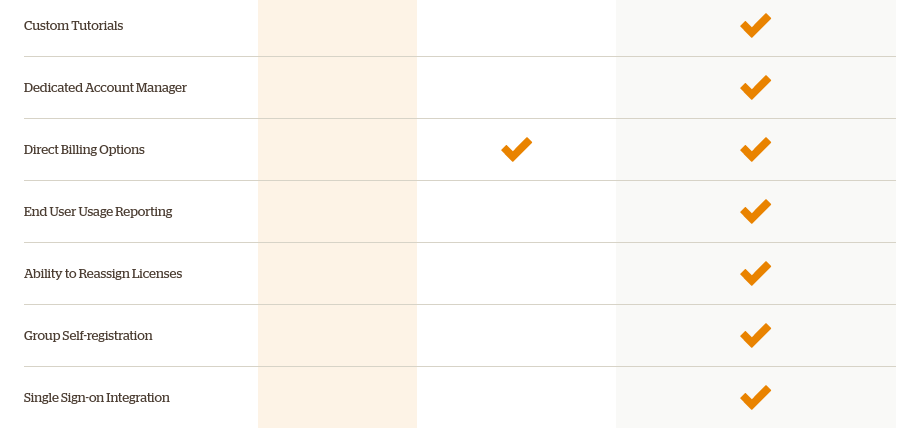

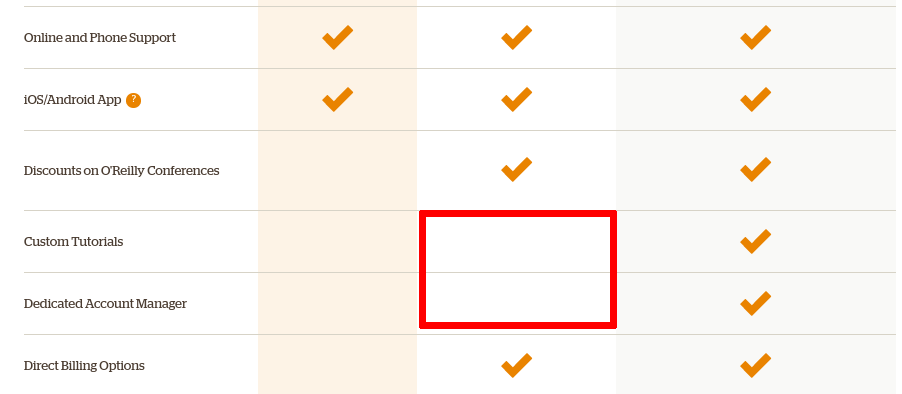

The only differences between the two lower plans appear to be Direct Billing Options and Discounts on O'Reilly Conferences. Neither would appear particularly significant in nature.

Direct Billing Options

The appearance of Direct Billing Options is extremely puzzling. Not only does it clutter the page, but it adds absolutely nothing as a differentiator. It serves only to detract attention from the core value being offered by the firm (informational texts and videos).

It is nearly impossible to imagine a business offering that does not include direct billing as standard, just as it is difficult to assume that a physical book would not include physical pages, text and a cover. Additionally, the appearance of Direct Billing for the higher of the two tiers could cause many potential buyers of the Pro plan to wonder if they won't be billed directly - and if not, wonder how they would be billed at all.

Discounts on O'Reilly Conferences

The Teams plan includes Discounts on O'Reilly Conferences.

The retail price for O'Reilly conferences tends to exceed $2,000. Obviously, the total cost to participants is considerably higher. Once airfare, hotel charges, meals, loss of productivity / billable hours are included, the cost for a business to send an employee to a conference could potentially be double the face value of the ticket.

Unfortunately, the pricing page contains no information with respect to the magnitude of the discounts offered, nor the frequency with which they are offered. It is unclear if the discounts are made available for all events, or simply those that are unable to draw sufficient participants. Without any data, it is literally impossible for potential buyers to perform any mathematics in order to make a business case that membership at this level is worth the expense.

The value of these discounts becomes even more dubious when one considers that a quick search on the internet (using Safari's exact terminology) reveals sizable discounts that can be obtained without purchasing a subscription to Safari's service at all. The less information provided about the discounted tickets, the more likely that potential customers will perform searches online to estimate the value of the discounts. These searches will remove any hint of value attributed to this feature of the Teams plan.

Given the similarities between the two plans, it is likely worth collapsing the two plans into a single plan. This will simplify the product offerings without reducing income to the company.Comparing the Teams and Enterprise Packages

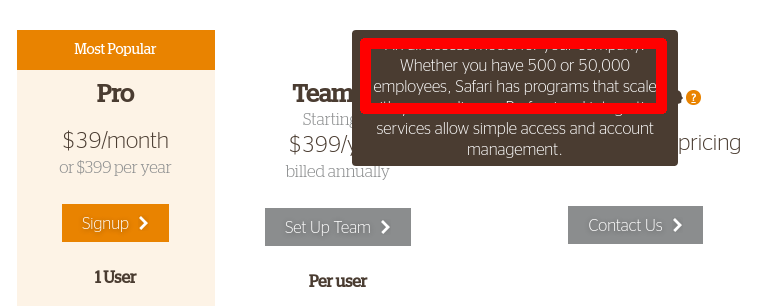

There is no public price for the enterprise package. This fact is neither unusual, nor cause for concern. Companies generally hide their prices for enterprise packages in order to increase both flexibility in offering and billing rate. That said, Safari's ability to profit from its enterprise plans is likely hindered by its existing pricing strategy.

Enterprise plans should never be interpreted by marketing strategists as pricing at a reduced rate for features that big businesses want. Instead, enterprise plans should be thought of as extremely expensive options at an increased per seat price, tailored to the needs of customers with very deep pockets.

The enterprise plan is a firm's one (and only) shot at making outsized quantities of money for offerings tailored directly to the needs of large, possibly unique, firms. For that reason, it is essential to demonstrate that massive value can be added - for the right price.

The signaling of massive increases in value delivered is almost entirely absent from the Enterprise plan's details.

The majority of the features that have been added to the Enterprise plan appear to be mainly conveniences, rather than massive value-drivers.

Yes, options like Single Sign-on Integration and Ability to Reassign Licenses may be valuable. They may even be required features for enterprise sales, but few executives wake up one day and exclaim "I would throw buckets of money at a company, if only they offered group self-registration!"

Of the six add-ons attached to the Enterprise plan, only one (Custom Tutorials) represents a possibility for extreme value. Yet there is no description about what the tutorials might cover, how long they will take to design, how many can be requested or how detailed their content will be. Not only that, but even its name seems uninspired. It is impossible to say without proper A/B testing, but it is likely that Customized Online Training might generate more interest than Custom Tutorials, despite the fact that both mean exactly the same thing.

There are two methods that could be used to add extreme value to the Enterprise offering.

The first is to consider how Safari's products could add more value by opening up opportunities for network effects. Offering some method for a firm to share commentaries, remix existing content into personalized training materials, create company-specific discussion boards, earn certifications and integrate existing documentation with Safari's online materials would not only allow for network effects at very little cost to Safari, but enable the firm to charge more. As an added bonus, it would also generate significant lock-in effects for Safari's customers. No firm would consider canceling its subscription when much of its internal knowledge and documentation is tightly coupled with Safari's products.

The second is to think about the types of offerings that generate large sums of money from other businesses. Many experts receive tens or even hundreds of thousands of dollars for delivering speeches and presentations. Safari could make its authors available to present to enterprise customers. Not only would this represent an additional source of income for the firm's writers and for Safari itself, but it would also help build the authority and value of the Safari brand. Safari would be recategorized in users' minds from a website with books to the company that let me hear fantastic speakers. On a per dollar investment basis, speaking engagements have the potential to yield dramatically higher revenues than "custom tutorials."

Unbalanced Offerings

One common mistake made by businesses is to front-load value on the lowest tier offered. Adding too much value to the lowest-priced packages prevents the firm from charging premiums to customers who are both willing and able to pay for value. After all, if all of the desired functionality is available at a low price, why would a customer spend more? There are a few methods that can be used to reduce the effects of this mistake, but there is rarely a reason to go down that rabbit hole to begin with.

There are currently 17 features available to users, and the numeric breakdown does not appear to be weighted too heavily to the lowest tier.

| Pro | Teams | Enterprise |

|---|---|---|

| 9 | 11 | 17 |

However, a detailed investigation demonstrates that the value delivered is heavily weighted toward the lowest tier.

At its core, Safari is a provider of education (mainly in the technology space). Of the 17 features available across the three plans, only a third of them are actually core to the mission of the organization:

- Books

- Video Courses

- Audio Books [sic]

- Conference Talks

- Rough Cuts (draft editions of books)

- Custom Tutorials

The first five are made available in unlimited quantity to those on the lowest-level plan. This leaves little ammunition for the company to incentivize customers to upgrade to a higher tier of service.

| Pro | Teams | Enterprise |

|---|---|---|

| 5 | 5 | 6 |

Whether the addition of non-core features was due to managerial oversight, or an attempt to disguise the defects in the value distribution between plans, is outside the scope of this document. Nevertheless, the distribution should likely be rebalanced.

It's difficult to say which options should be removed from the lowest tier without access to proprietary information, but here are a few particularly likely candidates:

- Video courses - When it comes to informational products, video is more valuable than text. Bibliophiles will often argue that video is less information-dense than well-written text, it's less skimmable and more difficult to reference. Nevertheless, it's almost a truism that people will pay more for video content, whether it's because of its ease of consumption, the effort heuristic or something else entirely, is irrelevant.

- Rough cuts - Though hardly font and center on the pricing page, the "rough cuts" is an excellent candidate for exclusive availability at higher plans. Described as "early access to content on cutting-edge technologies - before it's published," the rough cuts could prove extremely valuable to those working on the bleeding edge of technology. Almost by definition, the newer the content, the fewer sources of suitable information will exist, and the more consumers will be willing to spend for access to them. It is possible that there may be managerial pushback to this option as access to rough cuts may have been intended for gathering reader feedback prior to the materials' official release, but it is likely that those who are most willing to pay for access will be those who are most willing and able to provide feedback in the first place.

- 'Unlimited' access - Some readers will pay a premium for access to more materials. This may mean charging for access to a larger selection of topics or higher limits on the number of books that may be read in a given unit of time.

It can be difficult for managers (especially those with a strong engineering background) to realize that cost and price have no relation to one another. Even though the marginal cost to deliver many of Safari's features approximates zero, some of those features likely represent a significant increase of value to buyers. As such, Safari should focus on charging according to the value delivered to the buyer, not the costs of the seller, assuming that the firm intends to maximize its profits.

As a general piece of advice, if marketers feel the need to add 'filler' add-ons to product tiers in order to differentiate each offering in a product lineup, there is a strong possibility that the business needs to better identify the types of customers that it is targeting.

Issues with the Teams Package

Even if Safari doesn't intend to change the details of the Teams package, two sections of descriptive text should be modified immediately.

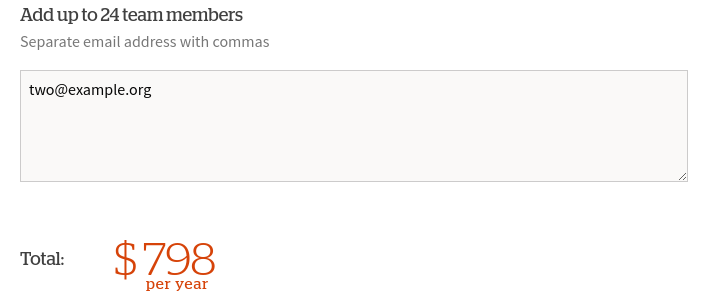

Starting at...

There is a bit of grayed-out text stating that the price of the Teams package is "Starting at" $399.

Unfortunately, the phrase "starting at $X" (especially when made difficult to read) has become synonymous with "the actual cost is much higher than $X." This will trigger defensive thinking on the part of many readers and cause them to view an offering with increased suspicion. There is no reason why Safari should risk causing such behavior. The text does not appear to indicate that the per-seat price will increase, but that the price is proportionate to the number of accounts ordered. For this reason, the text should be clarified by some means. The phrase "$39 / user / month" would be one example of a suitable replacement. Not only will this be more readily understood, but it will allow for direct comparison with other plans that are offered by Safari.

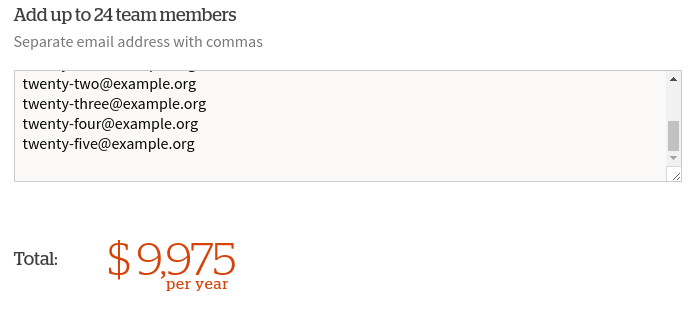

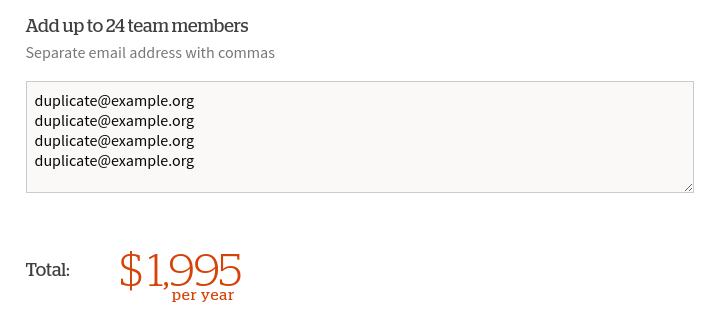

Volume Discounting

One of the benefits touted to buyers of the Teams plan is "volume discounting."

Volume discounting is an oft-used technique to woo the buyers who have the greatest ability to pay. Though more information would be required to definitively say that this technique should not be used in this case, there is almost certainly a problem with Safari's implementation of volume discounting.

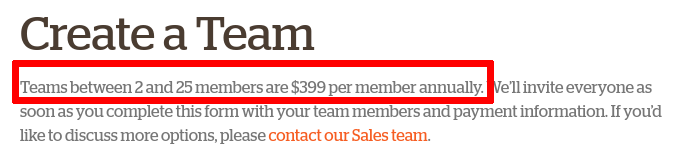

When a potential customer selects the Teams plan, he learns that no volume discount is available.

Indeed, no matter how many users are added to a plan, the per-seat price appears to remain the same: $399.

Clearly, either the pricing page or the purchasing page needs to be updated to reflect the existence or absence of volume discounting.

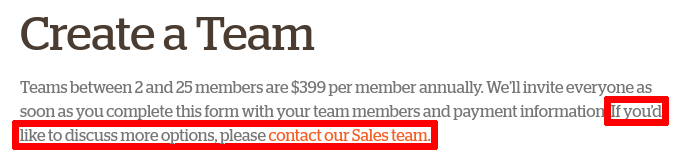

Hidden Options

Pricing pages are traditionally used to provide a list available goods and services to customers. Would-be buyers are prompted to select one or more options and then submit the appropriate payment.

The buying process for visitors who decide to purchase the Teams package is a little more complex. Once they select the Teams package and are ready to submit the appropriate payment, they are informed that the sales team may be contacted for additional options.

This message does nothing but add unnecessary friction to the buying process. Many retailers have found the purchase page to be an excellent opportunity for upsells. For instance, online bedding companies will often ask customers if they would like to add a bed frame to a mattress order.

Safari's message represents something completely different. It's not a call to select a ready-made addition, but to seek out a different (and completely undefined) option entirely.

Forget that corporate buyers (who likely make up the bulk of those interested in the Teams plan) likely spent significant time shuffling paperwork to receive permission to buy this specific plan at this specific price. This web page is actively stopping a person who is ready to buy and encouraging him to reconsider his purchase. Some may delay their orders as they consider this new option while others might postpone their purchases indefinitely.

Why would a company ever act to halt a purchase in progress?

The message seems even more peculiar when one realizes that the linked contact form is for the Enterprise plan, an offering that (by Safari's own statements) is only available for teams with more than 25 users (a user count above the upper limit for the Teams plan). It seems as though buyers are being told to stop buying the plan that is intended for them and to consider another plan for which they are ineligible.

Plan Highlighting

Many businesses offer multiple packages but use highlighting to direct buyers' attention to a specific package. In almost every case, the highlighted plan will be a mid-tier offering and be labeled as either most popular or best value.

This pricing page has taken the unusual approach of highlighting the least costly option.

This is nearly unheard of for two main reasons:

- It reduces marketing pressure for buyers to consider more expensive plans. When the cheapest plan is highlighted, a buyer's natural inclination to select a mid-tier plan is halted. The fact that the lowest-tier is described as Most Popular adds social proof to the lowest priced option and leads potential customers to wonder why they would need to spend more than the average customer.

- It reduces the stature of the seller. The company likely earns the bulk of its revenue from enterprise plans. That said, identifying the lowest-tier as the most popular builds the image of a business that caters specifically to small buyers. This may reduce the valuation of the offerings in the eyes of enterprise customers and cause them to demand larger concessions before signing a contract.

Given that plan availability is based purely upon the number of seats desired, there is absolutely no benefit to highlighting any offerings at all. The labeling only serves to clutter the page and take attention away from more important information.

Tier Naming

Safari could potentially benefit from modifying the package naming system.

First, there's a grammatical issue. Pro and Enterprise are both singular whereas Teams is plural. While this may appear as a minor nitpick, it does look like a grammatical error, and many detail-oriented buyers expect excellent copy from a publishing house.

More importantly, Pro is essentially meaningless in this context. Since the "tiers" are based upon team size, the naming should reflect that. For instance, the following tiers would make more sense:

- Individual

- Team

- Enterprise

Such a system would reinforce the segmentation criteria between plans and allow buyers to zero in on the appropriate plan very quickly.

Standardization of Units

Retail outlets are constantly mixing units of measurement, in an attempt to confuse consumers about relative product pricing. The average consumer will not know if a beverage offered at $25 per hogshead is a better deal than another offered at $5 per litre.

When dealing with purchases that are not made in the blink of an eye, it's best to ensure that customers don't feel the need to whip out their calculators or perform arithmetic calculations.

Nevertheless, the pricing page for Safari does just that. The only two packages with defined pricing have different units listed.

As discussed earlier, the actual difference in cost between the two plans is precisely $0 per seat, when purchased on an annual basis. The change in units from monthly pricing to yearly pricing confuses the issue. The higher of the two tiers appears to be more than ten times the price of the lesser plan, due to the change in units.

If the firm is dead-set to offer the Teams package at $399 per user per year, its price should be listed in the price per month, billed annually. The income generated would remain the same, but potential buyers would be able to compare the relative prices more easily. More importantly, the pricing for the Teams plan will seem cheaper because customers' mental models will be based around a lower number. This may be just enough to convince stingy, but illogical, managers that the benefits of the higher plan are worth the cost.

Quick Kills

Much of the discussion thus far has centered on strategy and would require discussions at the highest levels of the firm. That is not to say that there aren't changes that can be made quickly, yet still have a positive effect upon the firm's bottom line.

Explicit Segmentation

There are three packages being offered, yet only one specifies the number of accounts for the given plan.

If a team of thirty is too large to be considered for the Teams plan, then the size requirement should be made clear from the outset. Specifying the number of allowed accounts will reduce the cognitive load for potential shoppers and direct them to the appropriate plan quickly and efficiently - before they have second thoughts.

The lack of any indication of the appropriate sizing of each plan is made worse by the misleading text that suggests that the Enterprise plan requires hundreds of users, when it fact it only requires 25.

Non-negotiable requirements should be clear from the outset. Otherwise, customers will be forced to search for information before placing an order. Remember that frustration and search time aren't just annoyances. They are sources of friction that could represent lost sales, or, at the very least, increased lag time between product introduction and a closed sale.

It would be very simple to add the necessary information. No additional space would be required on the page.

Consistent Spacing

The pricing page should be one of the cleanest pages on a website. Much of the information presented is categorical in nature, and it is the last page a user will see before deciding to make a purchase.

The pricing page for Safari should be revised to ensure that elements between plans are vertically aligned with each other in order to ensure a professional appearance.

Nonstandard Spelling

Although "audio books" (as two words) appears often on the internet, "audiobooks" appears to be the preferred spelling. Given that the product being offered is from a publisher, the more widely accepted spelling may be important to maintaining the brand's image of quality.

Minimizing Potential Refund Requests

The team setup page contains a fairly significant defect. It does not check to see if the email addresses of users are unique.

A careless buyer might accidentally add a given user twice and be charged an extra $399 for his mistake. Resultant errors might be caught by customer support at a later date, but why let it get that far? The inability to prevent duplicates is a potential source of aggravation for customers and a potential source of accounting hassles for Safari. A small bit of JavaScript could catch duplicate email addresses as they are entered and smooth the buying process.

Pricing Table Cohesion

Many companies use a table format with check marks to show the increasing value offered by higher-level packages. An exceedingly small number of businesses utilize a gap in a given tier's offerings. Safari is one of those businesses.

This gap may prove useful for some advanced pricing techniques such as decoy pricing, but this is clearly not the intent for the Teams plan. Grouping features contiguously ensures that potential buyers don't stop scrolling too early and miss information that will encourage them to buy.

Given that packages are determined by the number of accounts requested, there is little reason to force potential buyers of the Teams package to focus their attention on features not available on their plan.

As such, the "Direct Billing Options" item should either be moved up by two rows, or (as has been suggested elsewhere in this document) removed entirely.

Summary of Recommendations

There are ample opportunities to improve Safari's pricing strategy. Collectively these changes have the potential to significantly increase profitability for the company.

Recommendations include:

- Categorize potential customers into addressable archetypes.

- Create pricing tiers that offer increasing levels of value in exchange for increasing prices.

- Keep descriptions simple and differences in value clear.

- Reduce friction in the sales process when possible.

- Aim for consistency of messaging.

Most importantly, consider hiring an expert to help guide you in the process of updating your pricing strategy. It doesn't have to be my company, but it should be someone who has more than just a passing familiarity with the subject of monetization.

Contact Information

This document was created by TapRun, LLC.

For further information (or for input on your pricing strategy) please contact us via our website at TapRun.com.