The Pricing Maturity Model

Friday, June 15, 2018

Introduction

Every company approaches the world of pricing in its own way. The correctness of methods employed, the quantity of data interpreted, and the business objectives targeted can differ greatly from one vendor to the next. As a result, it should be of little wonder that some firms achieve great successes via pricing, while others are left to flounder.While there are sites chock-full of excellent advice for vendors to price their wares appropriately, relatively few in the field have attempted to create a proper maturity model for vendor pricing. This represents a terrible oversight. Without any framework for analyzing pricing methods, firms will find themselves unable to gauge their abilities or understand how their efforts must evolve in the future.

My proprietary four-stage model is an attempt to correct this oversight. As firms become more highly skilled and experienced in the field of pricing, they will naturally alter their approaches to match those depicted in the higher stages. Of course, backsliding is possible, should companies lose the courage, skills, or pricing power that enabled their prior ascension.

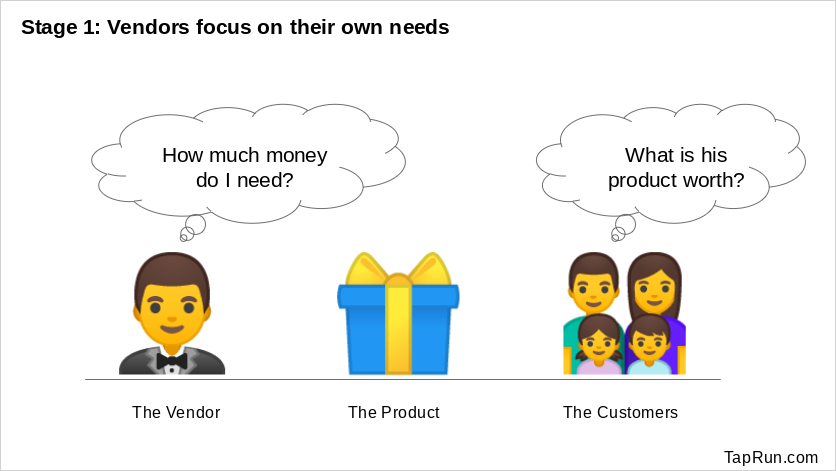

Stage 1: Vendors focus on their own needs

Vendors will often begin their pricing efforts by looking inward at their own needs. In this stage, pricing is selected solely to attain business objectives.

Questions commonly asked by firms in this stage include:

- How much income would it take to break even?

- How soon can variable costs of production be covered by revenue?

- How much income would be required to match an alternative source of income? (This is especially common for entrepreneurs who seek to match their previous salaries.)

Looking inward tends to be as irrational as it is ineffective. Firms at this stage tend to be characterized by a total disconnect with the customers that they attempt to serve. As a general rule, customers will care little for the needs of vendors and will rarely find a place for such concerns in their purchasing decisions (donations to charitable institutions excepted).

Many businesses will find themselves firmly entrenched in this stage, but some of the more common types include:- Businesses that are undercapitalized - Firms that have a very limited runway are forced to make a profit quickly. The risk of failure can be overwhelming and push managers to focus myopically on their costs.

- Businesses that lack sufficient data - Many firms do not possess the initiative, skills, or resources to collect sufficient data for setting up a pricing strategy.

- Businesses that are run by managers who don't know better - Many firms are led by people who have not been trained to approach pricing as a strategic endeavor. This may be due to a lack of experience, or significant amounts of time spent working in a commodity-focused marketplace.

Note: Although vendors should not look inward to determine proper pricing, they should always consider their costs (both opportunity and otherwise) when determining whether a product should be offered in the first place.

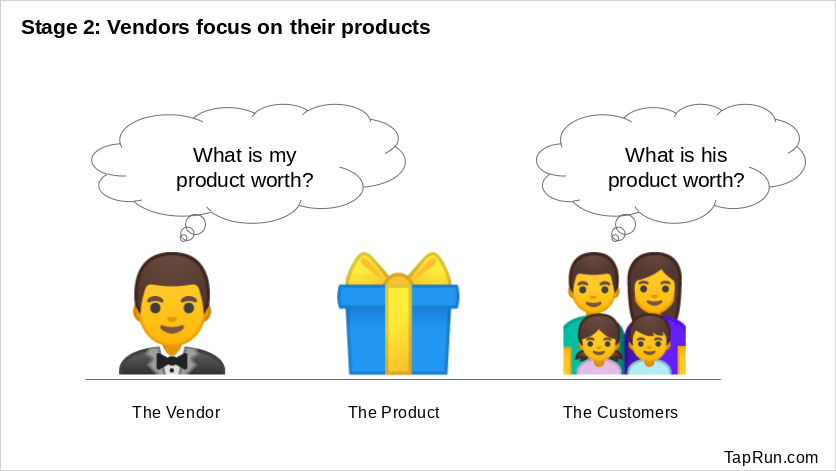

Stage 2: Vendors focus on their products

One of the most common questions vendors ask is "What is my product worth?" That question dominates the thinking of all vendors in this stage of pricing maturity.

There are many methods that firms can employ to discover the answer, but the following two methods seem to prove the most popular:

- Matching the prices that have been selected by competitors. (This is generally a poor idea for all but the most extreme examples of commodities, and even then the logic can be questioned.)

- Adding up the price of the inputs to an offering and then tacking on a surcharge. Many service providers including waiters, real estate agents, and recruitment agencies have earned their incomes using this method, but there is often a better way.

As pointed out in my pricing manifesto, products do not generally have value, in and of themselves. Thus, attempting to use the perceived value of an item to set pricing can prove highly problematic. A shift in thinking away from features offered by a product and toward the benefits that it bestows is critical to arriving at a reasonable pricing strategy.

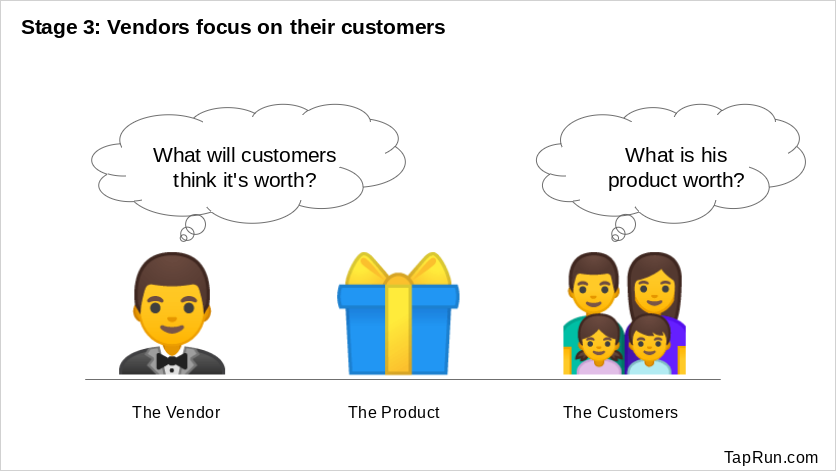

Stage 3: Vendors focus on their customers

This stage has traditionally (and incorrectly) been viewed at the pinnacle of pricing maturity for vendors.

Firms at this stage understand that the prices that they can charge are dependent, first and foremost, upon the buyers' ability and willingness to spend. Just because an item required significant resources to create, or bears a striking resemblance to another item with an established price does not mean that the optimal price will be simple to figure out.

For most offerings, the ideal price for a good will be based upon customers' perceptions, preferences, and values. If buyers are willing to spend a lot of money to acquire a given product, it makes sense for vendors to take that fact into account.

Although some vendors in this stage attempt to understand the buying behavior of the masses, most firms will find value in segmenting the market to identify a subset of ideal buyers who would most highly value the product being offered.

As pointed out in What the Market Will Bear, many offerings will be valued at vastly different levels by different segments in the market. Some customers may be ready and able to devote vast fortunes to making a given purchase, while others would be uninterested at any price.

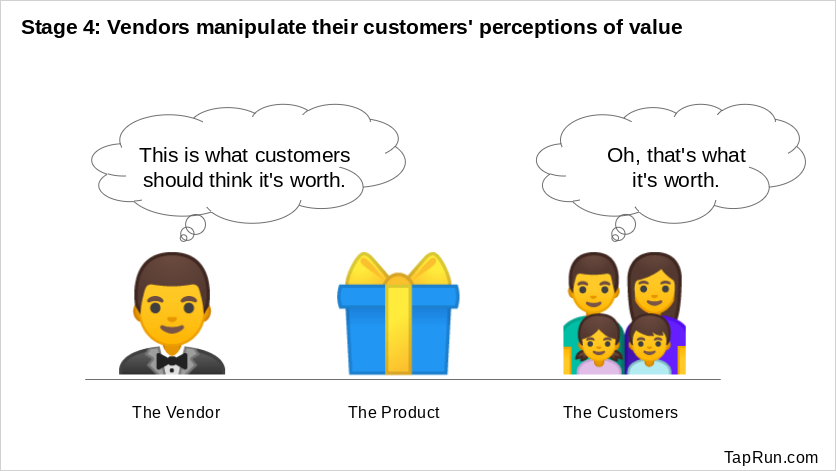

Stage 4: Vendors manipulate their customers' perceptions of value

This stage represents a fundamental shift from those that came before it. While the others represented attempts to understand reality, this stage is focused upon manipulating shoppers' interpretations of reality.

Unscrupulous vendors will find themselves immediately attracted to this stage - and for good reason. Fortunes have been made by exposing potential customers to fear, uncertainty, and doubt (FUD). The truly dishonest go even further, relying on outright misrepresentation. Although the long-term ramifications of such methods will tend eventually to destroy the pricing power of the firms that employ them, large sums of money can be earned in relatively short timespans. Honest vendors will often reject the principles outlined in this stage without a second thought, dismissing it as a dangerous combination of Orwellian thinking and fraud.

The truth is that it need not be either. Yes, this stage is full of moral hazards, but often tweaking customer perceptions and model building can be to their own benefit.

As described in The Product Manager's Visual Guide to Feature Selection, many buyers lack the wisdom, intellectual horsepower, time, or knowledge sufficient to make an informed decision. When a person visits a hospital, goes to a mechanic, or opens a retirement account, he will often benefit from a vendor's guidance. As long as firms can create a reputation of trustworthiness, they can explain why their offerings justify higher prices.

Back in 1949 when seat belts were first introduced, many car buyers would have questioned their importance. Why should they spend more money for ugly devices that require effort to use? It was only through the manipulation of their mental models, that customers began to realize that the devices represented a quantum leap in safety technology and were worth significant sums of money.

Conclusion

Vendors shouldn't simply think of setting a price as a singular act. Pricing requires growth in capabilities and a constant focus upon increasing the maturity with which it is undertaken. Being able to understand which phase a vendor is in and what steps are necessary to achieve the following stages are critical to turning pricing from a mere necessary task into an important component of vendors' strategic plans.